Are you ready to stop paying rent and move into your own home in 2025? That’s a big and exciting step — but we know the thought of home loans, banks, and paperwork can be overwhelming.Don’t worry. This blog is here to make things super simple. No heavy terms, no confusion — just easy, useful information for complete list for documents require for home loan . Let’s break it down step by step.

📋 A Complete Checklist of Documents Required for Home Loan

Having your documents in order is key. Here’s what you’ll need based on your job type:

✅ home loan for salaried employees

- Aadhaar Card & PAN Card

- Any address proof (like electricity or gas bill)

- Last 3 months’ salary slips

- Bank statements (last 6 months)

- Form 16 or ITR (last 2 years)

- Property documents (builder file or sale agreement)

✅ home loan for self-employed

- Aadhaar & PAN Card

- GST registration or business license

- ITR for last 3 years

- Profit & loss report

- Bank statements

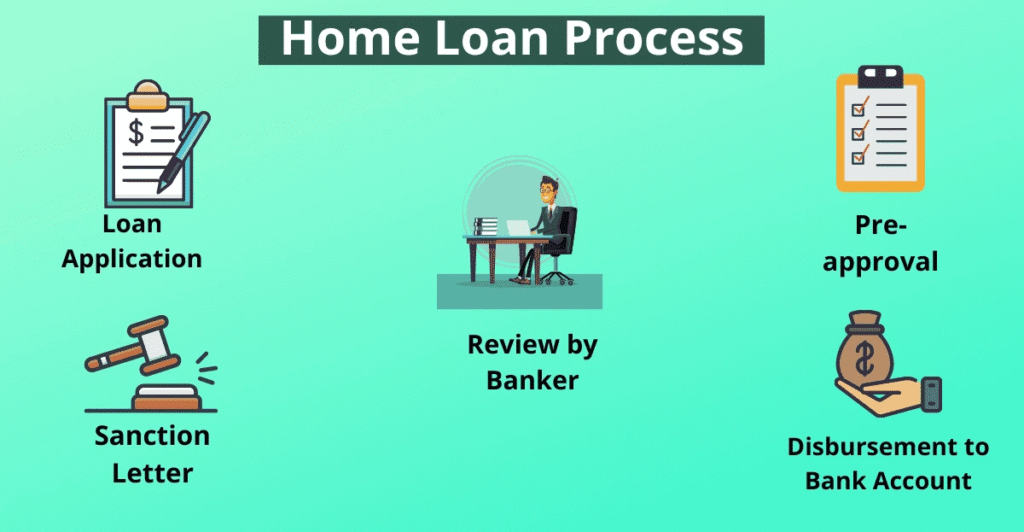

🔁 Step-by-Step Home Loan Process

Here’s a simple breakdown of the process

1. Check Your Eligibility

How much loan you can get depends on your income, CIBIL score, and liabilities.

2. Choose the Right Lender

Compare offers from:

- Banks: SBI, ICICI, HDFC

- NBFCs: Piramal, Indiabulls, PNB Housing

NBFCs are usually faster and more flexible if your CIBIL score is below 700.

3. Apply for the Loan

Submit your documents online or at the branch.

4. Document Verification

The lender checks your profile, job/business, and property details.

5. Get the Sanction Letter

It includes the approved amount, interest rate, EMI, and loan period.

6. Final Checks & Disbursement

Once everything is cleared, the bank releases the funds directly to the builder or seller.

💡 Smart Tips for Easy Approval

- Maintain a CIBIL score above 700

- Don’t delay credit card or loan payments

- Add a co-applicant to improve eligibility

- Choose a loan term with comfortable EMIs

- Don’t apply to many lenders at once

- If rejected by a bank, try an NBFC — they are more flexible

🏡 Making Home Loans & Property Deals Simple – With Guru Mahadev

Guru Mahadev Real Estate Pvt. Ltd. is a well known name in Uttam Nagar West delhi real estate market from past 15+ Years, who is helping people to buy their dream home and making this home loan process so easy by giving complete support and guidenss through flat purchasing process, If you’re looking for a affordable flats deal through simple and easy process of home loan , our dedicated team is here to guide you in every step of the way.

💼 Here’s How We Make It Easy

- Step-by-step home loan assistance

- Tie-ups with top banks and NBFCs

- Help even if your CIBIL score is low

- Full support with documentation & follow-up

🕒 We help most of our clients get their home loan approved in just 10–12 days – no long waiting!

📞 Let’s Get You Home

If you’re serious about owning your home in 2025, don’t waste time worrying about the loan process. Let Guru Mahadev Real Estate Pvt. Ltd. handle the tough part while you focus on choosing the perfect flat.

📍 Visit Us: Near Nawada Metro Station, West Delhi

📱 Call / WhatsApp: 9811911906

🎯 Final Conclusion:

A home loan may sound tough, but with the right support near you — it turns into a smooth process.

So why wait? Let Guru Mahadev Real Estate help you turn your home dream into a reality — step by step.

People Also Ask (FAQs)

For a home loan, you need identity proof (Aadhaar, PAN, Passport, Voter ID), address proof (Aadhaar, Passport, Utility bills, Rent agreement), income proof (Salary slips, Form 16, ITR, Bank statements), property documents (Agreement to sell, Title deed, Property tax receipts), and other documents like passport photos, loan application form, and sometimes an employer NOC.

The home loan process begins with checking eligibility, where the bank assesses your income, credit score, and repayment capacity. Next, you submit all necessary documents for identity, income, and property. The bank then conducts verification and processing, including financial checks and property legalities. Once everything is verified, the bank gives sanction/approval, specifying the loan amount, interest rate, and tenure. Finally, after property valuation and legal checks, the loan is disbursed to the seller, and you begin EMI payments.

Most banks require Income Tax Returns (ITR) for the last 2–3 years when you apply for a home loan. This helps the bank verify your income and repayment capacity. If you are salaried, submitting 2 years of ITR along with salary slips is usually enough. For self-employed applicants, 3 years of ITR and bank statements are generally required to show stable income.